Dividends / Dividend policy

Dividends

Shareholder returns policy

Our fundamental policy is to stably redistribute profit, to set long-term prospects and prepare for the capital required for investment into research facilities and production facilities, to respond to the trends of each field of business, to enhance our competitiveness and improve our earning power. Our shareholder return policy is active and stable dividends and flexible stock acquisition, and we aim to achieve a total payout ratio of 50% or more or a DOE of 2.5% or more during the period of Med-Term Management Plan 2026.

Date of record for dividends

End of term:December 31

Mid term:June 30

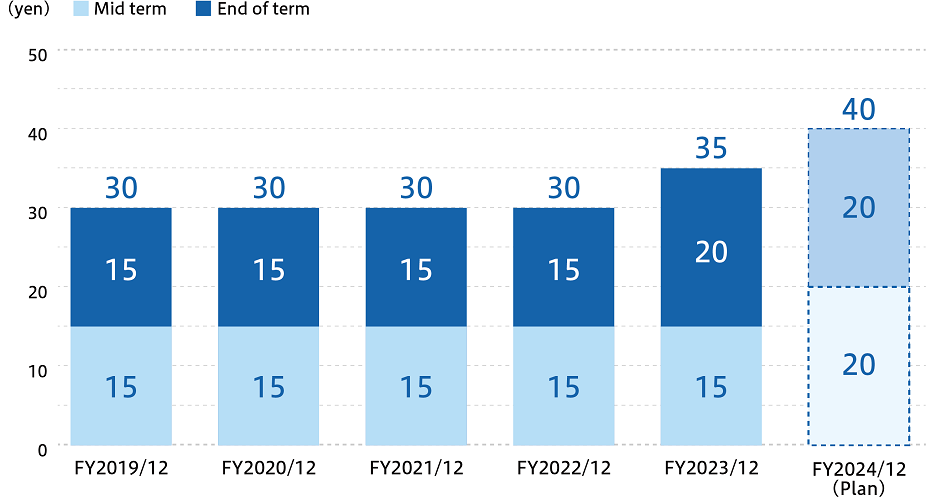

Fluctuations in the dividends of a single share

Shareholders' special benefits plan

About shareholders' special benefits plan

We would like to first thank all of our shareholders for their continued support. Our goal is to increase the number of medium- to long-term holders of our shares by raising the appeal of investing in those shares.

Eligible shareholders

Shareholders who are listed or recorded in the shareholder register as of December 31 of that year and who also hold at least one unit of shares (100 shares) are eligible.

The Content of shareholders' special benefits plan

| Held shares | Holding duration | Contents of shareholders' special benefits |

|---|---|---|

| At least one unit (100 shares) | Less than 1 year | QUO card worth 500 yen |

| 1 year to less than 3 years | QUO card worth 1000 yen | |

| 3 years or more | QUO card worth 2000 yen |

Continuous holding period refers to the number of times a shareholder, who holds at least one unit (100 shares) of shares, is consecutively listed or recorded in the shareholder register on June 30 and December 31 every year under the same shareholder number.

Less than 1 year: listed two or less times in the current shareholder register

1 year to less than 3 years: consecutively listed three or more to six or less times in the current shareholder register

3 years or more: consecutively listed seven or more times in the current shareholder register

Gift period

Scheduled to be sent out every year in late March after the annual meeting of shareholders, along with the Notice of the Resolution of the Annual Meeting of Shareholders.